As I said, I make LOTS of mistakes but I am fortunate to have astute readers to correct me.

In a comment on my last article, Tom Walsh noted that the article from which I took that $15 trillion figure for “debt” was not about debt— but deficit. Not the same thing. Thank you Tom!

So, I started thinking about the issue of deficits and debt and their relationship, which is an interesting one and leads in many directions.

Debt vs. Deficit: An Overview

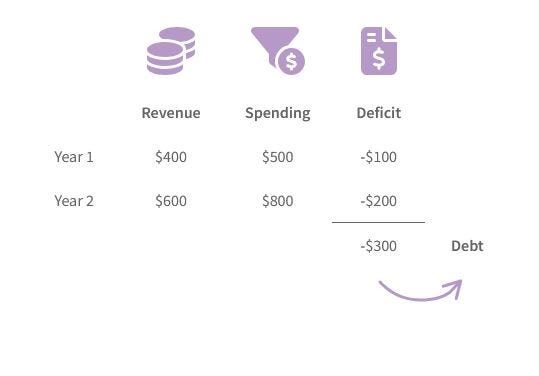

Debt is any money that is owed to someone else. The term deficit refers to a situation where costs exceed income, or liabilities exceed assets. Debt can be not just the accumulation of amounts borrowed but also, years of deficits that may add to it.

Debt and deficit are two of the most common terms in all of macro-finance. They're also the most politically relevant, inspiring legislation and executive decisions that affect many people.

Although people often use these words interchangeably, they are inherently different and the magnitude of each doesn’t necessarily have anything to do with the other. But they can have plenty to do with people's situations, the health of corporations, and the well-being of an underlying economy. Investopedia.

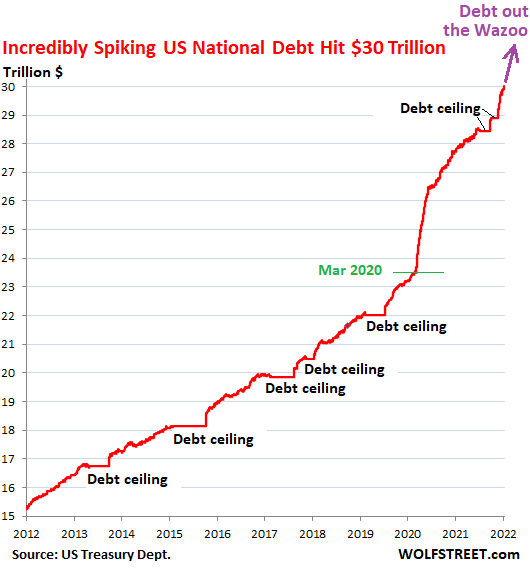

Obviously, the US deficit will increase the national debt, at least with current economic policy, which does not favor industrial growth or productivity Here’s what the NYT says.

America’s federal budget deficit rose to $1.8 trillion in the 2024 fiscal year, reaching the highest level in three years, according to new Congressional Budget Office estimates released on Tuesday.

The increase from last year’s $1.7 trillion deficit came as tax revenue failed to keep pace with the rising costs of government programs and the mounting interest on the national debt.

The figures show the continuing fiscal strain facing the U.S. economy, where the national debt is approaching $36 trillion. Despite steady economic growth and low unemployment, annual deficits are growing again after declining from pandemic-era highs. In September, the final month of the fiscal year, the United States recorded a $63 billion surplus, according to C.B.O.

America’s reliance on borrowed money to fund its priorities and pay its bills is not expected to end any time soon. Both Vice President Kamala Harris and former President Donald J. Trump are proposing policies that, if enacted, would cost trillions of additional dollars over the next decade. Much of that spending is expected to be financed with borrowed money. New York Times

All very confusing for someone of my lukewarm IQ.

Fortunately, we have the US Treasury to explain further…. with pictures!

What is the relationship between deficits and debt? Let us keep in mind that there is external debt— and internal debt. The ratio here is important. With the dollar as the Reserve Currency, the US never had to worry about External Debt-- until now. Nor too much about deficits.

Simply put, the national debt is similar to a person using a credit card for purchases and not paying off the full balance each month. The cost of purchases exceeding the amount paid off represents a deficit, while accumulated deficits over time represents a person’s overall debt.

The U.S. Treasury uses the terms “national debt,” “federal debt,” and “public debt” interchangeably.

Deficits: living beyond your means

Thank you, treasured Treasury people.

From this I take it that the US is in trouble. Doesn’t matter who is in power. The Blowhard or the Bimbo.

What is the relationship between deficits and debt? Duh. Even I get it.

How to get by when you live beyond your means. Borrow.

Or steal.

A lot depends on who you borrow from. And who you steal from. The US does both. Depending.

Debt avoidance

Let us keep in mind that there is external debt— and internal debt. The ratio here is important. With the dollar as the Reserve Currency, the US never had to worry about External Debt-- until now. Therefore didn’t caretoo much about deficits. It was counting on not having to pay back what it borrowed to cover overspending. That’s one of the perks of hegemony.

When other countries run sustained trade deficits, they must finance these by selling off domestic assets or running into debt — debt which they actually are obliged to pay. It seems that only the Americans are so bold as to say “Screw the world. We’re going to do whatever we want. Michael Hudson

Hudson wrote that in The Bubble and Beyond back in 2012.

Sadly, that day has passed for the US. It doesn’t own the world anymore. Financialization has come back to bite it But it is only the public that has tooth marks . But the Government and the 1 % still needs money. A lot of it. More and more and more. Which leads to…

Proxy wars as debt management strategy

The US fights proxy wars because they are financialized like everything it does —and profitable for its remaining. , mostly non-productive industries in the MICIMATT complex. It makes a killing from others doing its killing.

It fears the economic as well as the political and social consequences of real peer-level war which might burst the delusionary bubble it has created for the public mind.

Remember, the US did not win WWII in Europe. Rather, Germany and the rest of Europe lost— which allowed the US to create its empire and the Imperial Dollar.

The US’s proxy war in Ukraine , which was supposed to beggar and bugger Russia, is actually doing that to Europe with the US profiting from reduced industrial competition, weapons sales, financial manipulation and selling energy at exorbitant prices.

That war is almost over. And Europe is pretty much a bloodless corpse.

Next proxy war please! That could be Iran. MICIMATT is pretty happy with that adventure now. Billions of dollars flowing in to pay for missile and aircraft and munitions! Iran killed 20 F35s and some F15E? MICIMATT hopes so.

Of course, Israel will lose and go bankrupt. You might even get a new Israel-Palestine — a democratic state to replace the apartheid one, with Zionists moving back home to the US to cause trouble there.

The US will try to profit on that too while it moves on it next proxy war in the Far East. It doesn’t care.

There won’t be a war against China, of course. All the possible proxies—Japan, Korea, the Philippines are too weak. But MICIMATT can profit , with vassal states in the region, increasing defense spending.

Is the war across the sea?

Is the war behind the sky?

Have you each and all gone blind:

Is the war inside your mind? Tlm Buckley

Yes, we have all gone blind.

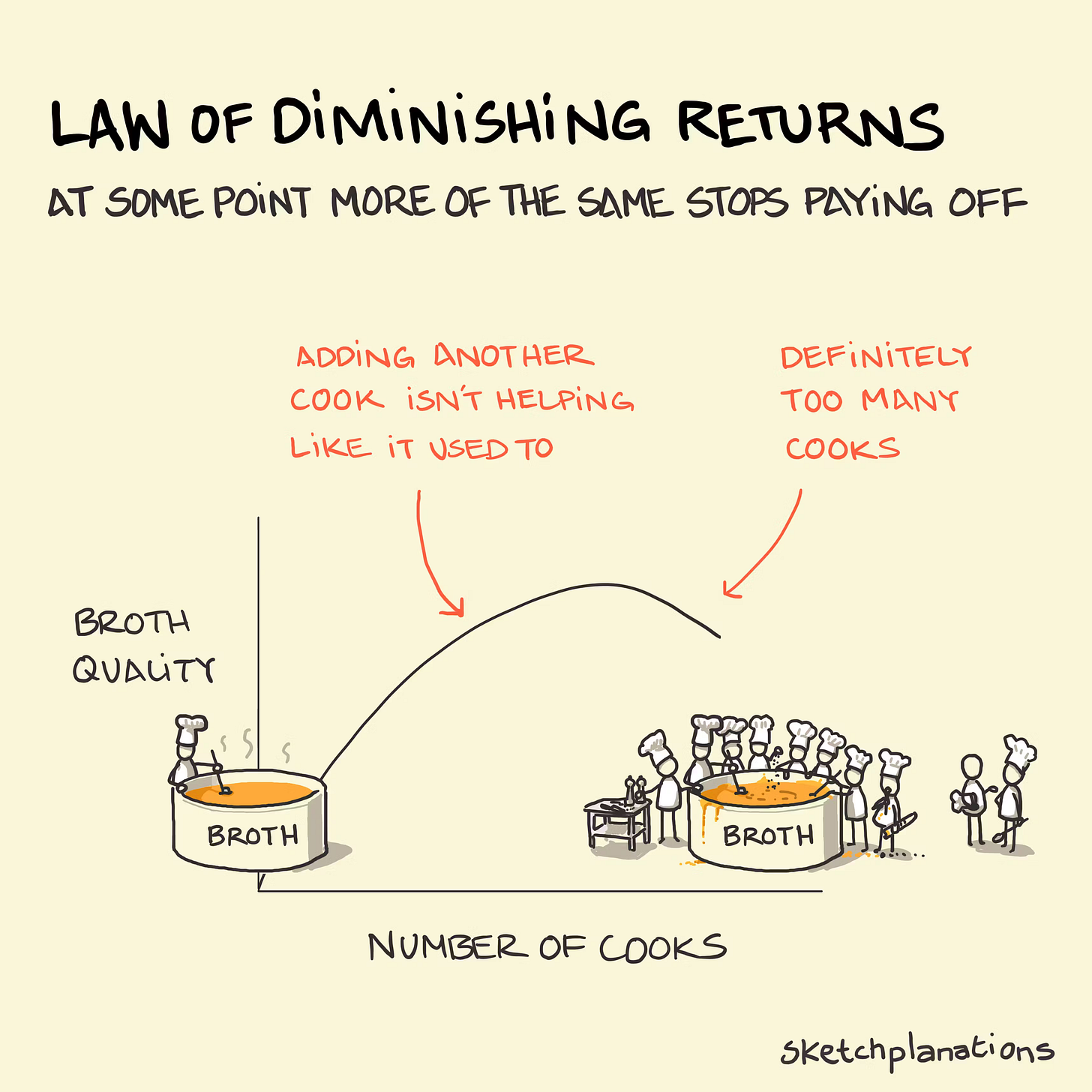

Law of Diminishing Returns

But…financialization means only the very wealthy profit. Ordinary people don’t. At some point, the public will just say “no”.

I hope, anyway.

At some point the Law of Diminishing Returns comes into effect.

Of course it’s not about cooks . Rather, financial capital . Take the F35 program which will cost the American people around $1.75 trillion over its 50 year lifetime. Half of the fleet still can’t fly. We are blind to that too.

No matter, the F35, useless or not, is selling like hot cakes to American vassal states to counter the Russian/ Chinese / Iranian “threat”.

Too bad that Russia and China have changed the dominant political algorithm, with their vision of multipolar world—what FDR envisaged years ago—and doing more with less, for less.

BRICS provides an alternative for all those who want freedom and international democracy as FDR envisioned in 1944. And stuff that’s cheaper and better.

In the meantime, the US is blind and deaf.

It must die to be reborn. And maybe then join BRICS.

Special Article Part 3

Part 3 is almost finished now. So, I am hoping to send it this weekend.

I see that Emmanuel Todd is much in the news This week B. at Moon of Alabama —who also agrees with me about US proxy wars (more or less) also wrote about him.

Special Articles Part 1 and 2 explain Todd and how his theories fit in with those of others like Hudson.

So, if you didn’t get Part 1 or 2 and want them, let me know when you buy coffee and I will send you links—along with Part 3, of course, which focuses on democracy or the lack thereof.

Thank you for your patience. These articles take a long time. I keep on researching and revising. Part 3 is in its 12th revision.

Please click here to buy me and Ichi and Chappy a coffee and get on the mailing list.

I think you're missing the elephant in the room wrt the US deficit. Why does it exist in the first place?

Consider fictitious country "G". Their government creates currency for the people to use. The currency is issued to people when they perform labour. For the sake of simplicity, let's say each person is given 1M (M = moni, the currency of country G) for each hour of work. At the end of each day a worker may have 8M. That money is his, it's not a loan. He can now use that to buy other services, like food or shelter. There is no debt. The M has actual backing (labour) and is valuable and pretty stable.

Now let's take country "U". Their government doesn't create currency. They have outsourced the money creation to a private club called "I" (I for Idiotic). When someone does work in U, the goons in government (gig), ask "I" to lend it to them, they give the borrowed money to a big bank, which lends it out to an employer, who pays the worker 1D (D = dumb). All this is done at interest and the loans have to be paid back. Ironically, "I" doesn't have anything that they lend out, they just create what they lend out to the government of U on the fly by an accounting entry. The worker at the end of a day has 8U, but it doesn't belong to him, it has to be paid back, with interest by the employer to the bank, which has to pay it back to "I". If, by sheer will and tenacity such is loan is paid back, the people of U have nothing again and the process has to be repeated. Since the repayment of the loan is always more than the original loan because of interest, it is impossible for U to ever pay back their loans, unless they borrow more.

Any primary school child can probably point out that country G is much better off than U, even if U has a booming economy for a while. U lives in a bubble that bursts at regular intervals and then the problem is recreated on a bigger scale.

Any marginally intelligent child could also point out the solution. U can simply let the scammers at "I" go fly a kite, shut the idiotic process down and issue their own currency. It will immediately solve the deficit problem (the debt will vanish into thin air since it doesn't really exist in the first place), but the people of U will have to rework their system. All the hedge fund managers, most of the banksters, and whole lot of other parasites will have to find actual gainful employment or become manufacturers.

Because the monetary house of cards collapses, a lot of other things will to change as well, like the ending of "investments" of foreign entities in utilities for example. If sure there are many more to add to the list.

Does that make sense to you?

Thank you for the Financials update...

I follow on YouTube Lena Petrova, who despite her Russian name and face appears to be a(n apparently) perfect British-speaking American...

->https://www.youtube.com/@lenapetrova/videos (You can select a video. Newest on top)

She also has a Substack.

Also mainly on BRICS news, because she gives Geo-Economics lessons. And BRICS is hot news in that branch.

So i happende to know the difference and relation between Debt and Deficit...

Both of which i have evaded to meet in my own life...

Sander